A Sharp Decline in the Cryptocurrency Market Erases Last Week's Gains

Jul 10, 2018, 11:02PMThe cryptocurrency market is red today as the sector's weekend rally suddenly takes a turn for the worse. All assets in the top ten are down.

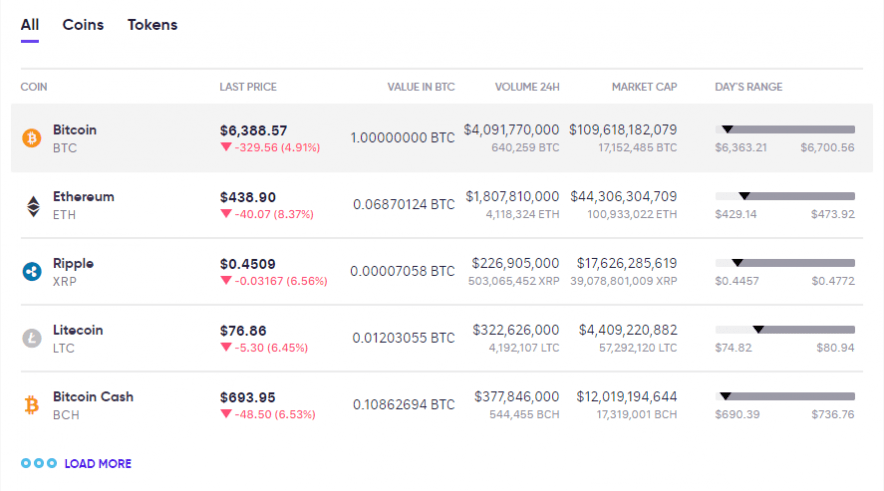

The cryptocurrency market is red today as the sector's weekend rally suddenly takes a turn for the worse. Many assets in the top ten are down by single-digits. And in the top hundred, the assets display similar performance with several of the more volatile coins falling by double-digits in the last 24 hours.

Today's downturn is unique in the fact that almost every single cryptocurrency has posted significant declines with very few exceptions. The dip has sent the total cryptocurrency market cap to $253 billion with Bitcoin dominance rising to 43.2% of the total. Transaction volume has fallen back to its monthly average of around $14 billion while asset price correlations intensify among the top ten.

Bitcoin and Ethereum Technical Analysis

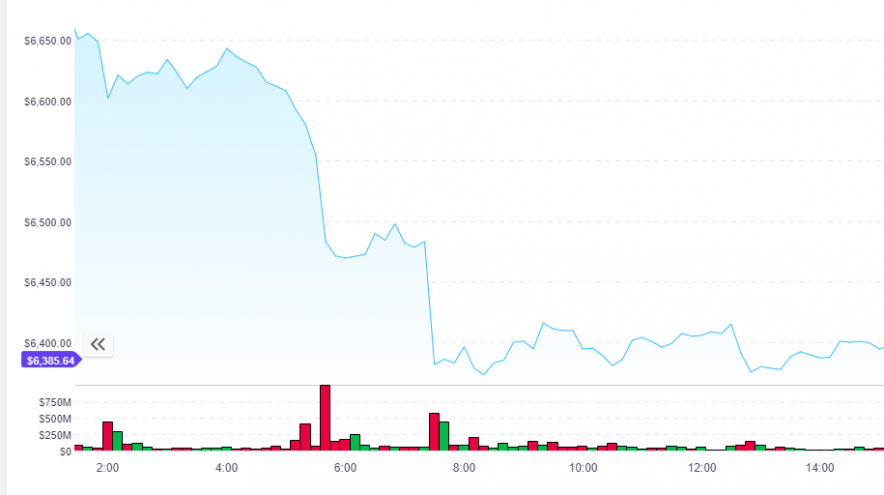

Bitcoin has fallen below $6,400, retracing all of last week's gains as negative sentiment takes over the market:

The downward moves come after a sustained rally since the start of July that had many believing BTC was awakening from its long-term bear market. Unfortunately, the declines are likely to continue. Daily RSI remains below 50, and the technicals suggest BTC may fall back to its 2018 lows of around $5,750 in the near term.

While price action remains highly correlated in the top ten, this recent cryptocurrency dip has hit Ethereum harder than Bitcoin. Ethereum's decline may have something to do with the recent mention of the asset by Elon Musk in a tweet posted shortly before the correction.

The Tesla CEO states, quote, "I want to know who is running the Etherium scambots! Mad skillz".

Ethereum's founder, Vitalik Buterin had the following response: "I do wish @elonmusk's first tweet about Ethereum was about the tech rather than the twitter scambots".

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.