Bitcoin Price Recovers from Virus-Led Market Panic, XRP, BAT, OMIC, Nov. 29

Nov 29, 2021, 6:24PM by Kevin George

by Kevin George

BTC recovers from virus-led sell-off. XRP seeing ‘good progress’ in court case. BAT hits new all-time highs. OMIC rallies on virus coincidence.

BTC

The Bitcoin price has recovered from a financial market sell-off driven by the spread of a new coronavirus variant.

A handful of cases of a new virus strain emerged in Africa before simultaneously traveling across the globe, causing governments to reinforce travel restrictions. The new virus variant was said to have produced ‘mild’ symptoms, according to the doctor who first identified it, but the western media ramped up the fear once more and governments followed their lead.

Bitcoin dropped to a low near $53,500 on the week as commodities were dragged lower. Oil was one of the worst-hit products, with an $11 loss on Friday.

The cryptocurrency market has since recovered with BTC back above the $58,000 level on Monday.

“Bitcoin is largely being grouped with other risk assets at the moment,” Matthew Dibb, COO and co-founder of Stack Funds, said. “After Friday’s collapse in equities, we have seen some buying in major coins, but it’s too early to say whether it will continue.”

Meanwhile, El Salvador bought another 100 Bitcoins after the recent price dip. The country has recently moved to make it legal tender alongside the national currency.

XRP

The price of XRP was back near the $1.00 mark after being dragged lower by the BTC moves.

Ripple’s CEO told CNBC recently that the company is seeing ‘good progress’ in the lawsuit with the US Securities and Exchange Commission.

Brad Garlinghouse also said he expects the case will likely reach a conclusion next year.

We’re seeing pretty good progress despite a slow-moving judicial process. Clearly we’re seeing good questions asked by the judge. And I think the judge realizes this is not just about Ripple, this will have broader implications.

Regulators are starting to close in on all cryptocurrencies and XRP has been adversely affected by the SEC’s complaint that it is a security.

Garlinghouse pointed to the United Arab Emirates, Japan, Singapore, and Switzerland as examples of countries showing “leadership” with crypto regulation.

“In general, the direction of travel is very positive,” Garlinghouse said.

XRP trades around the $1 level at number seven in the list of coins with a market cap near $50 billion. The $0.90 level is providing a potential double bottom for XRP but the path ahead will still depend on government actions over the virus with XRP holders having to wait until next year for the lawsuit to end.

BAT

One of the top-performing coins this week was the Basic Attention Token, with a move higher of 48%.

The project has seen interest after a recent partnership with Solana to integrate with the Brave browser.

The companies will work together to bring best-in-class wallet features for the Solana blockchain into Brave’s Web3 desktop and mobile browsers for the first half of 2022.

With more and more users and creators requiring tools for fast and affordable access to the decentralized Web, this integration will seamlessly pave the way for the next billion crypto users to harness applications and tokens - Brendan Eich, CEO of Brave.

“For billions of people, the mobile web will be their gateway to Web3,” said Anatoly Yakovenko, CEO of Solana Labs, adding:

“Deep integration with browsers is the key to helping DApps build the best web experiences. Brave’s announcement of Solana wallet support across all versions of their browsers is an important step to onboard the next billion users to Solana.”

Solana will help to enable the implementation of the Themis protocol developed by Brave on the Solana Network, which is a key feature of the BAT 2.0 Roadmap. Solana will encourage developers to promote BAT on DApps built on Solana and on the Solana network.

BAT is now ranked at number 69 in the list of coins by market cap with a valuation of $2.35 billion.

The current price of the token is $1.58 .41 after seeing new all-time highs near the $2.00 mark.

OMIC

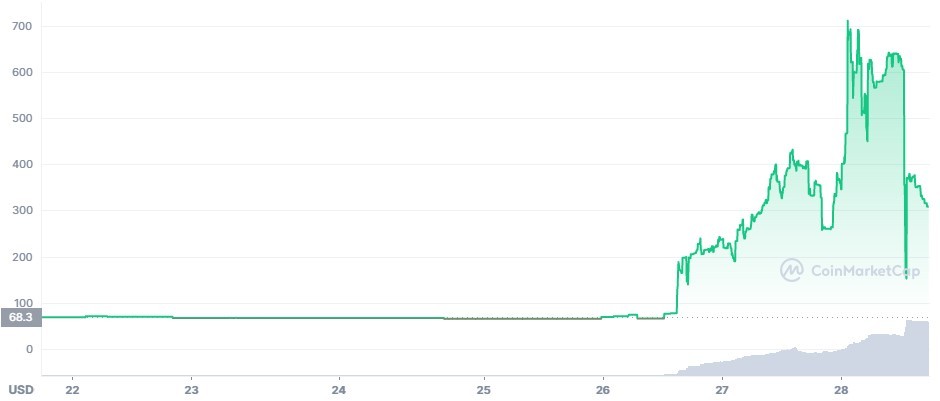

Omicron, a coin that shares the same name as the new coronavirus variant has jumped ten-fold on the week in another sign of a frothy and irrational crypto market.

The coin moved from around $60 to trade at $700 but has since lost half of its gains as reality sets in for investors.

The World Health Organization had taken to naming variants after letters in the Greek alphabet and the founders of the coin will have done so as many other financial companies and tools use Greek names such as Alpha, Beta, and Gamma.

OMIC is the native coin of a decentralized reserve currency protocol built on Arbitrum.

The project is a bond-based yield farming project built on Ethereum and there is no real reason to dive into the project for its coincidental relationship to the virus.

OMIC Holders can stake tokens to earn more. “The main benefit for stakers comes from supply growth. The protocol mints new OMIC tokens from the treasury, the majority of which are distributed to the stakers,” an official explainer says.

“Thus, the gain for stakers will come from their auto-compounding balances, though price exposure remains an important consideration.”

The cryptocurrency market has now grown to almost 15,000 different tokens with hundreds popping up every month. It can only be a matter of time before regulators clamp down on the sector.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.