Bitcoin Rocked by SEC Action on Exchange Staking, BNB, CAKE, BNX, Feb. 13

Feb 13, 2023, 4:39PM by Kevin George

by Kevin George

BTC rally gives way after SEC takes action against Kraken. BNB slumps 11% on contagion. CAKE loses on UNI moves. BNX is the week’s big gainer.

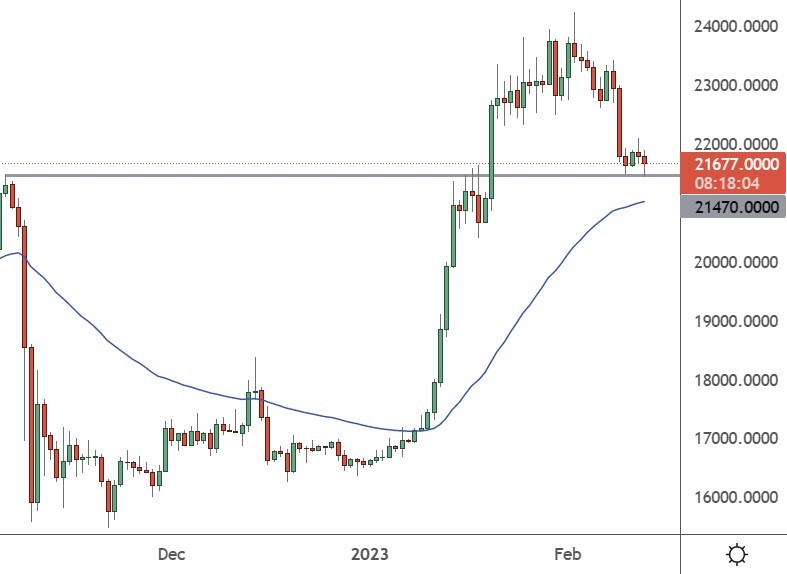

BTC

Bitcoin was 8% lower this week after regulators once again popped the bubble of the world’s largest cryptocurrency.

News that the Securities and Exchange Commission (SEC) was investigating the Kraken exchange led to bearish activity in the cryptocurrency market.

A settlement between the two sides was later confirmed in an SEC press release. Kraken was ordered to discontinue the “offer and sale of crypto asset staking-as-service”. The San Francisco-based exchange was also forced to pay $30 million to settle the SEC charges. An SEC press release said:

“Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries, when offering investment contracts in exchange for investors’ tokens, need to provide the proper disclosures and safeguards required by our securities laws,” said SEC Chair Gary Gensler. “Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.”

The move against Kraken led to speculation that the SEC would start clamping down on other exchanges such as Coinbase and Binance over staking-as-a-service. Shares of Coinbase fell 4.2% on Friday following a 13% plunge Thursday that has seen the stock forfeit roughly half of its year-to-date rally. Still, shares of Coinbase are up more than 60% in 2023. The SEC's settlement with Kraken came hours after Coinbase CEO Brian Armstrong warned Wednesday night of "rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers."

Bitcoin was trading at $21,650 on Monday after the SEC’s actions with $21,500 providing initial support ahead of the $20,000 key support level.

BNB

Binance Coin (BNB) was hurt by the staking news with the coin dropping 12% on the week.

That move meant that the $300 level was once again resistance for the project after a recent rally from the FTX exchange collapse market lows. The leading crypto exchange by market cap fell because Paxos was ordered to stop issuing the BUSD stablecoin.

Paxos announced that it would halt the issue of new BUSD stablecoins from February 21 after the orders from the New York Department of Financial Services The New York regulator said the order had arisen "as a result of several unresolved issues related to Paxos’ oversight of its relationship with Binance."

Binance CEO Changpeng Zhao was on Twitter Monday morning to claim that “all funds are (safe).” He also reiterated that Paxos will continue to manage redemptions of BUSD.

Zhao was concerned that Binance would start to see users “move away” from BUSD and toward other currencies supposedly backed 1:1 by the U.S. dollar. Zhao tweeted that his firm may also move away from USD-based stablecoins entirely.

"It is important to note that the Department only approved the Paxos-issued BUSD on the Ethereum blockchain," the regulator said. "The Department has not authorized Binance-Peg BUSD on any blockchain, and Binance-Peg BUSD is not issued by Paxos."

The price of BNB was trading at $288 on Monday as selling picked up on exchange tokens, following the recent developments.

CAKE

Pancake Swap (CAKE) was another victim of the exchange crackdown as the project dropped 13%.

The negative price action also has links to activity at its rival Uniswap exchange. The approval of a proposal to deploy Uniswap v3 on BNB Chain also sets up a showdown between PancakeSwap, Uniswap, and other DEXes.

The arrival of the Uniswap v3 is a headwind for CAKE as it is expected to be the most advanced dex on the market. On all five chains where Uniswap v3 has been deployed - Ethereum, Polygon, Optimism, Arbitrum, and Celo - it is the dominant DEX in terms of volume, according to DefiLlama.

Bringing the platform to BNB Chain is a big deal due to its greater capital efficiency. Uniswap saw a big rise in its dominance when it expanded to Polygon, almost wiping out the market share of Quickswap, which was based on a fork of an earlier Uniswap version- just like PancakeSwap.

The price of CAKE slipped under the $4.00 level to start the trading week. Pancake Swap has a market valuation of $650 million, while Uniswap has a valuation of almost $4.5 billion.

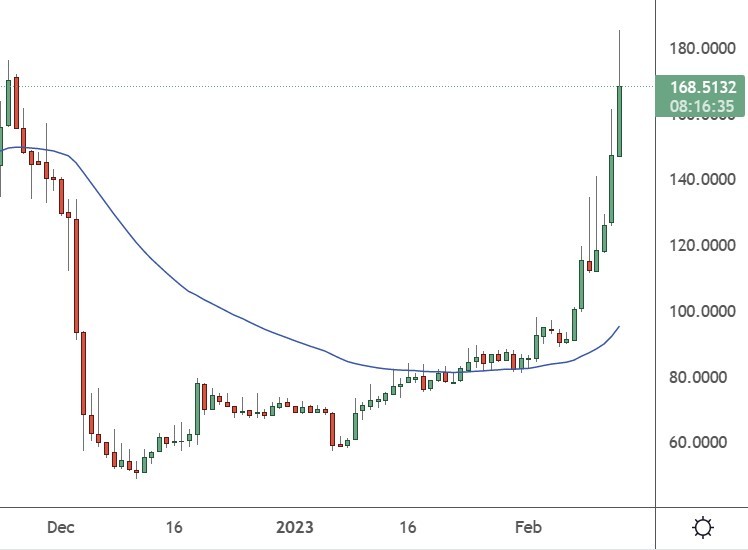

BNX

BinaryX (BNX) was the biggest gainer of the week with an 80% gain that saw the coin jump to number 80 on the list of coins.

BinaryX is a gaming platform that currently hosts the CyberDragon, CyberChess, and CyberLand games. CyberDragon is an online game which is based on the Binance Smart Chain and players can recruit heroes to fight through dungeon levels with the goal to defeat the ultimate boss- the CyberDragon.

BinaryX currently ranks at number 16 amongst the largest crypto games of the last month, according to data from DappRadar. The project saw 33,000 unique active wallets connecting with the games, which was up 190%.

BinaryX currently trades at $173.00 and the project has a market cap of $500 million.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.