Bitcoin Surrenders $30,000 Level on LUNA Crash, MKR, DEFI, May 16

May 16, 2022, 7:10PM by Kevin George

by Kevin George

Bitcoin price loses another 14% in a week of turmoil for crypto investors. Terra LUNA crashes to number 207 after stablecoin crash.

BTC

Bitcoin slumped below the $30,000 level in the last week was unable to hold its recovery above that key support level.

The collapse in the LUNA project continued to rattle cryptocurrency markets and part of the pressure on BTC was driven by LUNA, with the project unloading a huge sum of coins.

The Terra UST stablecoin reserves saw 80,000 BTC liquidated and had only 313 left.

“Consistent with its non-profit mission & focus on the health of the Terra ecosystem, beginning on May 8, when the price of $UST began to drop substantially below one dollar, the Foundation began converting this reserve to $UST,” LFG said in a Twitter thread.

The foundation said it was transferring bitcoin funds to a counterparty “to enable them to enter trades with the Foundation in large size & on short notice.”

That counterparty received north of 50,000 BTC in exchange for over 1.5 billion UST.

As the UST value kept dropping, failing to shoot back toward its supposed $1 peg, Terraform Labs, the tech startup behind the development of Terra, sold 33,206 BTC for 1.16 billion UST on May 10 “in a last-ditch effort to defend the peg,” LFG said.

Bitcoin has found some support at $30k but the last week’s turmoil has been bad publicity for the digital asset investment environment. The total market capitalization for the cryptocurrency market is now $1.25 trillion, after seeing highs near $3 trillion back in November.

The $30k level on BTC is very important as further weakness could drag it towards the $20k mark.

LUNA

LUNA saw its coin price collapse to $0.000245 in the last week as contagion spread from the troubles in the TerraUSD stablecoin.

“The Foundation is looking to use its remaining assets to compensate remaining users of $UST, smallest holders first,” LFG said in a final tweet. “We are still debating through various distribution methods, updates to follow soon.”

Terraform Labs founder Do Kwon proposed a “Terra Ecosystem Revival Plan” to salvage the project from the wreckage. Kwon’s “Revival Plan” amounts to a restart of the entire Terra blockchain, with network ownership getting distributed entirely to UST and LUNA holders through 1 billion new tokens.

The plan comes as Terra’s terraUSD (UST) stablecoin, which is supposed to be pegged to the price of $1, “death spiraled” below 15 cents this week – wiping out over $30 billion in value.

In Friday’s proposal, Kwon, who created the Terra blockchain with the Terraform Labs team, conceded that the Terra ecosystem has experienced total collapse.

“Even if the [UST] peg were to eventually restore after the last marginal buyers and sellers have capitulated, the holders of Luna have so severely been liquidated and diluted that we will lack the ecosystem to build back up from the ashes,” Kwon wrote.

He continued, “UST holders need to own a large share of the network, as the network’s debt holders they deserve to be compensated for the tokens they have been holding to the end.”

Kwon added that he was “heartbroken” for those that lost large sums in the Terra ecosystem, saying:

I still believe that decentralized economies deserve decentralized money – but it is clear that $UST in its current form will not be that money.

The founder also summed up the fragile issue of trust when it comes to other forms of money.

While a decentralized economy does need decentralized money, UST has lost too much trust with its users to play the role.

The blockchain underpinning LUNA and UST was shut down twice by validators over the past day.

MKR

Maker was the only coin this week which saw gains over the double-digit mark.

The project has benefited from the LUNA and Terra debacle as investors seek out more stable investment opportunities.

Maker’s MKR has risen by over 61 percent, according to Santiment feed, as the overall crypto market dips further. Sentiment on Twitter reported that the significant hike could be attributed to a recent spike in whale transactions propelling the asset by over 21% in a week and +18% in only one day.

“In our Daily Active Addresses vs. Price Divergence model today, $MKR appears to be generating a strong bullish divergence,” Santiment tweeted. “MakerDAO’s network indicates a high volume of unique addresses transacting, which often leads to a price spike with some sustained life.”

“When altcoins heat up, we’re positive that $MKR is a strong asset to keep a close eye on,” the business noted. “Watch to see if this divergence persists in the days and weeks ahead.”

The price of MKR has slumped since highs above $3,000 last May, with the coin now bouncing higher from support at $1,000.

DEFI

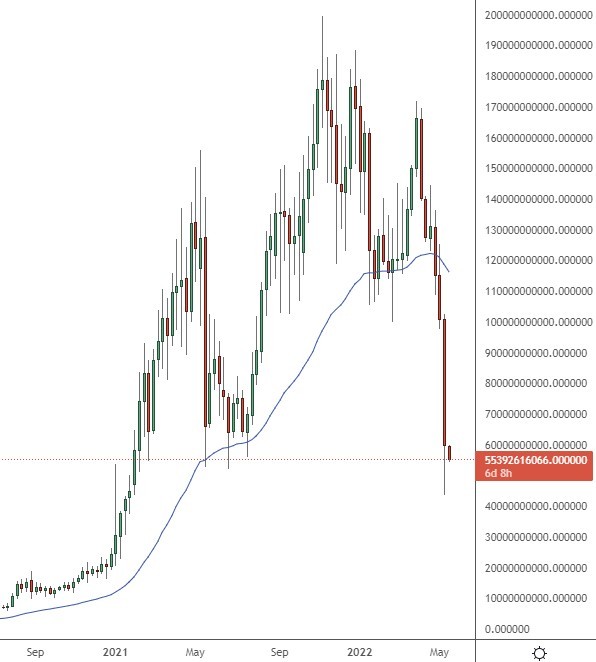

The decentralized finance market capitalization has slumped with the downturn in BTC and the LUNA chaos.

After highs near $200bn in DeFi assets, the projects have now slumped to around $55bn as the dreams of mass adoption have been hit hard.

Non-fungible token prices have also slumped as For NFTs,with Bored Ape Yacht Club's Otherside metaverse launch looking like a blow-off top. Back in April, some Bored Ape NFTs cost north of $400k. Now, with volume down 75% in the last week for Otherside NFTs, the market has seen the average floor price drop to 101 ETH ($200k) from 160 ETH ($480k at the time) at the end of April.

For a while, many assumed that NFTs had decoupled from the overall crypto market. In January, OpenSea exchange recorded a $4bn sales record in Ethereum-based NFT sales despite Bitcoin and the wider market coming under pressure.

The DeFi market may take some time to recover from the latest Terra and LUNA problems after trust in stablecoins has been rattled.

April was relatively good for memecoins, such as dogecoin (DOGE) and shiba inu (SHIB), which was largely due to Elon Musk's potential purchase of Twitter. However, there was big losses for decentralized finance tokens, including aave (AAVE) and thorchain (RUNE).

While BTC lost 17% as a benchmark, the broader DeFi sector lost 34% on average, closely followed by tokens of layer 1, or base blockchains, at 33%.

DeFi tokens have been the biggest losers on a yearly basis with over 71% in average drawdowns for investors.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.