Bitcoin Volumes Strong Ahead of CME Options, ZEN, ETC, LINK, Jan. 13

Jan 13, 2020, 7:27PM by Kevin George

by Kevin George

Bitcoin sees strong volumes on imminent option contract release. ZEN moves 37% higher. ETC completes a successful upgrade to keep pace with ETH.

BTC

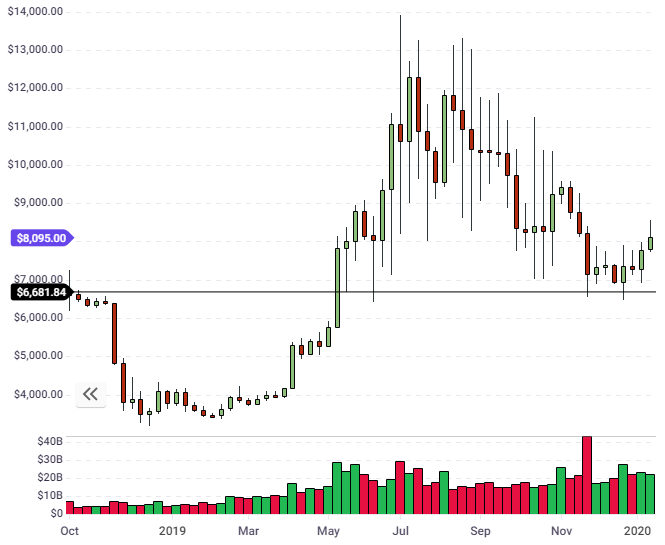

Bitcoin is still moving higher from the recent support and currently trading above $8,000. The move has been cautious so far but there is still potential for a catalyst to push the market higher towards the psychological $10,000 level.

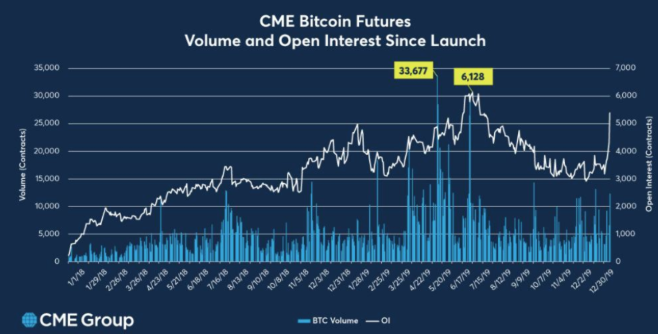

BTC has been boosted by strong futures volumes as the arrival of options trading nears for the world’s largest cryptocurrency. Last week’s volumes were approaching the record seen in June of 2019 and CME’s website now lists the BTC option as it awaits imminent regulatory approval.

The volume and developments in BTC are further evidence that the asset is maturing and is finding a rising status as a reliable alternative investment. The arrival of these types of products in BTC may be bearish for altcoins which can’t offer the same attractive propositions for institutions and professional traders.

FTX, the cryptocurrency derivatives exchange has launched its own options contract, which was announced in a tweet by CEO Sam Bankman-Fried. A later tweet suggested that volumes of $1 million had been seen in the first two hours.

Options are a vehicle which allows investors to pay a set fee (premium) for price target in the underlying product. If the asset moves through your chosen target then the option will pay out. If it fails to reach the target then the option expires worthless and the premium is lost.

Bitcoin’s price needs to see follow-through this week towards the $9,000-10,000 level.

ETC

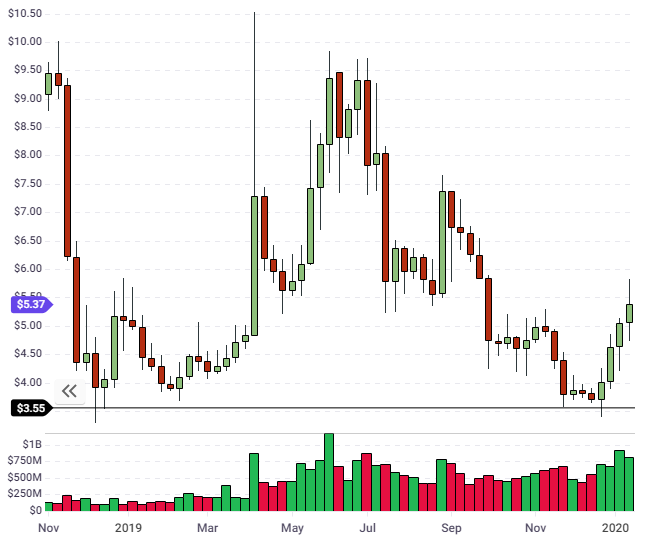

Ethereum Classic successfully completed the Agharta hard fork on Sunday at block number 9,573,000. The latest upgrade is another for ETC that is designed to make the chain more compatible with Ethereum.

ETC split from Ethereum three years ago following a DAO hack and now trades as a standalone currency at number 20 in the list of coins by market cap with a value of $625 million.

ETC now trades at $5.37 and has held a strong support level near $3.55. A strong couple of weeks in cryptocurrency could see ETC back at the $6.50-7.50 level once more.

ETC has 5 million more coins in circulation than its sister-chain ETH but the latter has a market cap of $15.6 billion which highlights the value available in ETC if it continues to keep pace with ETH upgrades.

LINK

The price of LINK was up 17% on the week and now trades at $2.17 with a market cap of $759 million which places the smart contract project at number 17 in the list of coins.

In a recent blog update, Chainlink highlighted their growing presence across Asia as they embarked on a multi-city trip across the region to push the adoption of smart contracts.

The blog stated the team’s intentions, saying:

This trip lays the foundation for the deep integration of Chainlink within Asian smart contract infrastructures and serves as the perfect blueprint for global expansion of the Chainlink team and developer community to match the international demand of our product.

LINK has found some support after a recent correction and now positions for another push to the $3.00 level and the all-time high of $3.75. LINK is still one of the best-performing altcoins since the beginning of 2019 with a rise of around 1,000%.

ZEN

Horizen was one of the best-performing coins on the week with a gain of 37% which pushed the coin above the $10.00 level. The move sees ZEN trading with a market cap of $84 million at number 52 in the list of coins. The resistance levels of $13.00-14.00 are now in play for ZEN.

Horizen is building a tech platform with optional privacy and allows application building and sidechains, with the ability to integrate third-party technologies. Zen utilizes the zk-SNARK technology and is the first cryptocurrency with full end-to-end encryption, whilst the project has one of the most active node systems in the crypto world.

BSV/BCH

I stated in last week’s article that BSV had the key resistance level of $150 in its sights and the coin rallied to get above there and trade at $163.00.

Meanwhile, BCH rallied $30.00 to trade at $263 and the coin will likely move towards the $300 level.

The arrival of Bitcoin options and volumes is providing a boost to the potential for both of the hard forks in Bitcoin cash. If BTC continues to emerge as a safe haven investment, or “digital gold”, Bitcoin Cash could see its value and adoption increase as a transaction currency in the same way as we currently use with gold for storage and fiat money as the transactional unit. The limited supplies in both would see a return to a “gold standard” type of setup.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.