BSV Explodes Higher as Altcoins Play Catch Up, BCH, ETC, DASH, Jan. 20

Jan 20, 2020, 2:29PM by Kevin George

by Kevin George

BSV sparked a rally in BTC forks with a move of 150% up early in the week. BCH still leads the forks. ETC futures boost that altcoin's price.

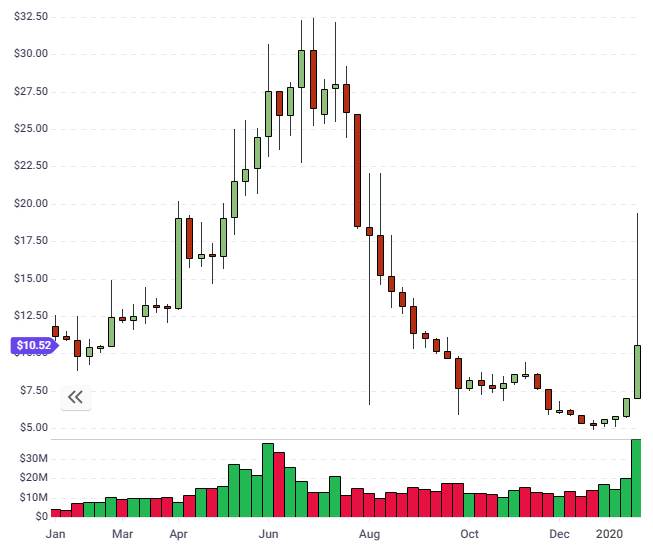

BSV/BCH

In last week’s article I followed up recent analysis on BSV and BCH to say that,

...if Bitcoin can rally in 2020, then BSV could follow with the first key resistance level of $150.00 now in sight.

The next key resistance level above there was $250 and following strong volumes in Bitcoin with the official first trading day of BTC options, BSV rallied hard through this level and touched a high around $458 for a gain of 150% on the day.

The price has since tailed off towards the $250 support level as volumes cool but this caps an impressive few weeks for the hard fork of Bitcoin Cash and a 65% gain on the week was still the best among the top 100 coins. This move could have been driven by value investors who see an arbitrage opportunity in the price differentials of certain coins. BSV and its sister coin BCH are literally the same but there have been negative issues surrounding the BSV project in the past but the sentiment has been improving and volumes surged in the coin, leading to a market cap of nearly $5 billion. Another reason for gains is the reports that the coin’s founder, the controversial Craig Wright, has acquired documents that may prove his hand in the initial creation of Bitcoin; which has long been his claim.

Others are more skeptical of the coin’s bullish run and point to the fact that, “99.4% of daily volume is made up of mainly no-name exchanges and known wash trading exchanges”.

BSV is now set for an early-February hard fork named Genesis, that the project claims will bring,

...the full restoration of Satoshis Bitcoin protocol bringing with it unbounded scaling and limitless economic potential.

The correction in BSV saw it losing ground and the 25% gain in BCH for the week sees that coin with a market cap of $6.0 billion with a price of $330.

I said that BCH had found support when it was at $237 and that it,

...gives hope that the coin can rally through the $350.00 level and attempt the $500.00 level once more.

Price has now rallied to that $350 level and the activity around there will determine whether it can gain further ground on XRP, which is a level above with a $10 billion valuation.

BTG/BCD

The week started well for Bitcoin forks as Bitcoin Gold and Bitcoin Diamond topped the gainers with 72% and 66% advances respectively. The pullback in BSV and BCH has led to these coins being dragged lower again as the volumes dried up.

Bitcoin Gold is a currency that is mined on GPUs, rather than the specialty ASICs, which always puts mining power in the hands of the biggest players. Bitcoin Diamond was a fork of Bitcoin that sought to reduce the transaction fees and slow transaction speed of Bitcoin by utilizing the Lightning Network technology.

All of these coins are similar to the original Bitcoin but their overall value be determined by adoption in the future and despite the fact that BTC and the Cash forks will likely continue to be the key players, there may be some good relative gains in the future for BTG and BCH if cryptocurrencies continue to see new investors and higher values.

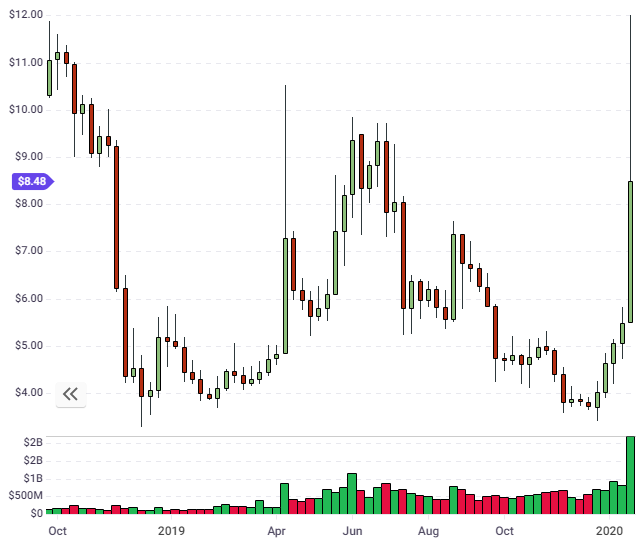

ETC

I also noted in last week’s article that Ethereum Classic had held onto a good support level and was pushing higher, where I stated:

A strong couple of weeks in cryptocurrency could see ETC back at the $6.50-7.50 level once more.

With a 51% gain on the week, ETC is now trading even higher at $8.30.

ETC’s move was driven by news of the launch of an ETC/USD futures product with up to 75x leverage available. As we have seen with the gains in BSV and BCH, ETC may have some ground to gain on the original Ethereum and this will be helped by continued development, where ETC’s founders have sought to keep pace with new updates in ETH. The rise in ETC has seen it touch the $1 billion market cap level once more and now trades just below that level.

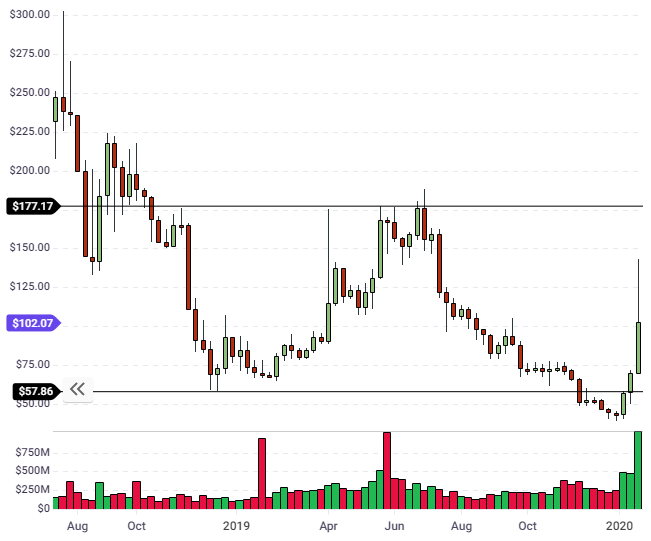

DASH

DASH was another top performer on the week with a 58% gain. The move in DASH takes it firmly above the recent support around the $58.00 level and the coin now trades at $100.00 after touching highs near $140.00.

DASH has been gaining on continued adoption in Venezuela as an alternative to the country’s struggling currency and another recent development for DASH was the release of a platform on Evonet, which allows the build of decentralized applications (dApps) on the network.

Resistance for DASH stands at the $177.00 level and continued gains for the overall cryptocurrency market could see the coin test that level. The market cap of DASH trades just below the $1 billion level and will jostle with ETC for 15th position in the days ahead.

For the overall cryptocurrency market, further gains are possible. Bitcoin traded above the $9,000 level on the week and this is still playing out from the monthly support levels of November and December. A strong close to the month of January could see BTC above the $10,000 figure.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.