Crypto Lending: The Latest Trend In Decentralized Finance

Sep 11, 2019, 12:45PM by Mike Dalton

by Mike Dalton

Cryptocurrency provides a basis for many different applications, one of which is crypto lending. Which lending platforms are leading the way?

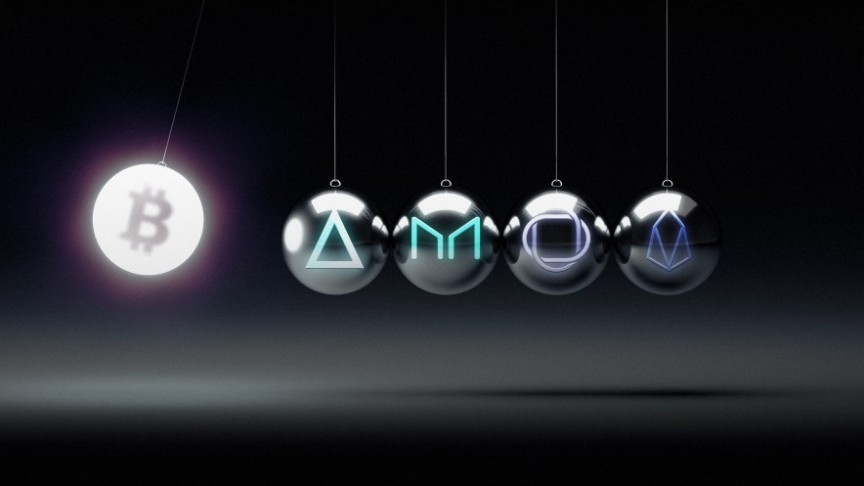

Decentralized finance is a vast landscape. The category includes just about any financial service built on a blockchain, including Bakkt's futures trading platform, Augur's prediction markets, Ethereum's DeFi apps, and almost everything in between. One of the newest additions to decentralized finance is cryptocurrency-based lending, which is being pioneered by several different services.

In fact, crypto-based lending is growing as we speak. Most recently, Silvergate Bank announced that crypto loans will be part of its extensive lineup of services. However, crypto lending takes many different forms, and not all of them are familiar. Let's take a look at a few popular crypto-based lending services―and a few niche platforms that take things in a new direction.

SALT Lending: Fiat Loans With Crypto Backing Options

SALT operates much like a traditional loan service―apart from the fact that it accepts cryptocurrency as collateral, that is. Essentially, SALT allows you to back your loan with Bitcoin or another cryptocurrency, and it provides your loan in U.S. dollars via bank transfer or as a stablecoin. Investopedia paints a more detailed picture of the service, and overall, it measures up quite closely to traditional alternatives.

SALT is, however, highly centralized. In order to comply with financial regulations, it must hold your cryptocurrency and verify your identity. It also must deny service to certain countries. This may seem restrictive, but regulatory compliance does benefit you in some ways. For example, SALT offers bank account integration and collateral insurance―two things that decentralized, unregulated services can rarely provide.

Despite SALT's efforts to stay on the good side of regulators, it has been targeted by the SEC, just like many other crypto startups that have recently run an ICO. It's possible that SALT's competitors will be able to work this to their advantage, but that hasn't happened yet. In any case, SALT is one of the most high-profile crypto loan providers, along with a few similar services like BlockFi and NEXO.

Lendabit: Peer-to-Peer Crypto Lending

Lendabit takes things in a different direction. It's a peer-to-peer lending service, meaning that you can do more than just borrow money―you can also lend out your crypto holdings and earn interest by doing so. Furthermore, if you do take out a loan, Lendabit will not dictate your rates―instead, you can find an offer that suits your needs, or you can set your own terms and wait for an offer.

Lendabit's peer-to-peer nature doesn't mean that it's free from regulations and restrictions. It still requires you to identify yourself, and it still blocks users in some countries. That said, Lendabit does take a hands-off approach at times. Unverified users can take out up to $300 worth of loans. Plus, since Lendabit lends out Tether instead of fiat currency, you don't need to link your bank account.

Most other peer-to-peer lending services also thoroughly comply with regulations. ETHLend, Nuo, and Coinloan are all heavily restricted in this way. As such, many of the most visible lending services don't provide absolute financial inclusivity, regardless of whether they are peer-to-peer services or not. However, as we'll see below, some niche platforms do provide much more accessible lending options.

MakerDAO: Collateralized Debt Positions

MakerDAO offers Collateralized Debt Positions (CDPs), meaning that you can lock Ethereum into a contract and receive MakerDAO's DAI stablecoin as a loan. MakerDAO relies entirely on blockchain technology and automated smart contracts, so there aren't any regulatory restrictions. Not only do you not need to reveal your identity, but it's also impossible to do so: MakerDAO has no individual lenders or operators.

MakerDAO does have a few downsides, though. Since 2018, MakerDAO's annual stability fees have been continually increasing, and there have been few reductions―currently, the fee is 18.5%. There is another issue as well: DAI doesn't have a lot of practical utility, and it is most useful as a leverage tool for cryptocurrency traders. As such, MakerDAO has niche appeal, even though it is an extremely open service.

EOS REX: Resource Lending For Developers

The EOS Resource Exchange (REX) is a somewhat unusual lending platform. For context, EOS is a blockchain that allows app developers to build their own DApps. Those developers also need to reserve network resources such as CPU to run their application, and EOS REX makes this more affordable. Developers can temporarily borrow resources at a low rate instead of buying them at full price.

EOS keeps resource prices low through a separate lending mechanism. If you hold EOS tokens, you can lend them to the REX pool and earn rewards. You'll temporarily give up your claim to resources, and due to the logic of supply and demand, this allows REX to reduce the price of those resources. This is obviously a very niche crypto lending platform, but it does serve a concrete purpose for EOS users.

Conclusion

Crypto-based loan services are promising for one main reason: they have the potential to provide financial services to those who would otherwise be unable to access those services. Unfortunately, this rarely works in practice. Popular crypto-based services face severe regulatory restrictions. Niche platforms, on the other hand, can operate freely, but they typically lack significant mainstream appeal.

Regardless, crypto-based loan services do give crypto investors a wide variety of options. Over time, various crypto-based lending services will come and go, and each service will introduce different restrictions. Even if no single service manages to strike a perfect balance between regulatory compliance and user freedom, there will always be plenty of different crypto lending services to choose from.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.