Ethereum Classic Blasts High on Coinbase News, BTC, BCH and ETH Analysis: Aug. 4

Aug 4, 2018, 12:41PM by Kevin George

by Kevin George

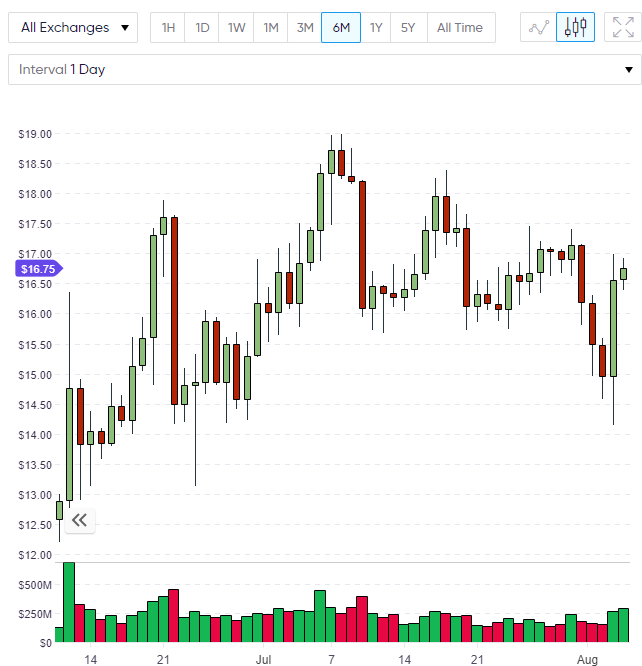

Ethereum Classic blasted higher yesterday, with a 14% gain on the day unwinding much of its losses on the week for a close near $16.50.

ETC

Ethereum Classic blasted higher yesterday, with a 14% gain on the day unwinding much of its losses on the week for a close around the $16.50 level. The spike in ETC was caused by news that Coinbase, the cryptocurrency exchange, was finalizing plans to list Ethereum Classic. A statement on the company’s blog stated that,

Today our engineering team is beginning final testing of support for Ethereum Classic (ETC) on Coinbase. We are making this announcement consistent with our process for adding new assets. We expect final testing to be completed by Tuesday, August 7, at which point we will announce that we’re ready to accept inbound transfers of ETC.

The move raises hopes that ETC can create a further rally over the next two sessions for a potential rally next week, although the behavior of the overall market may take some of the steam out of ETC.

Volume in Ethereum Classic saw a surge from $170 million to $270 million on the Coinbase news. At the time of writing, the total market capitalization of the cryptocurrency market was $264.3 billion, slightly lower than the 29th of July, where the overall market cap touched the $300 billion level.

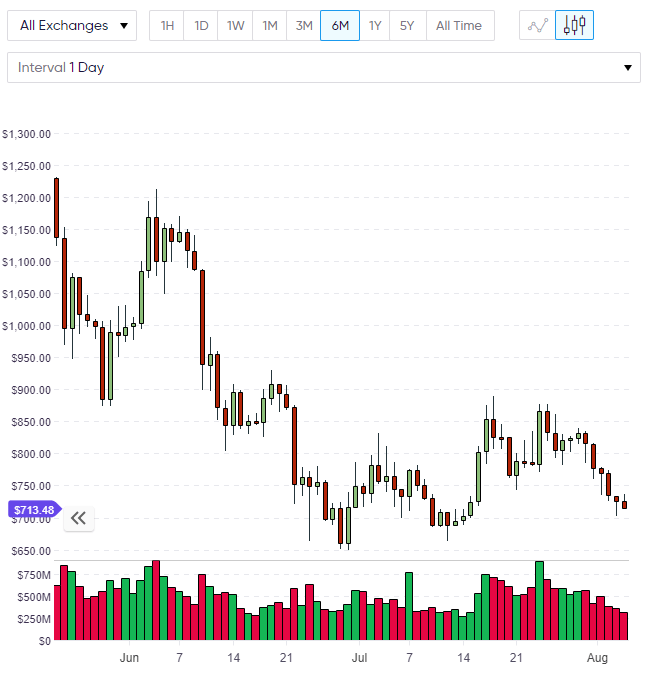

ETH

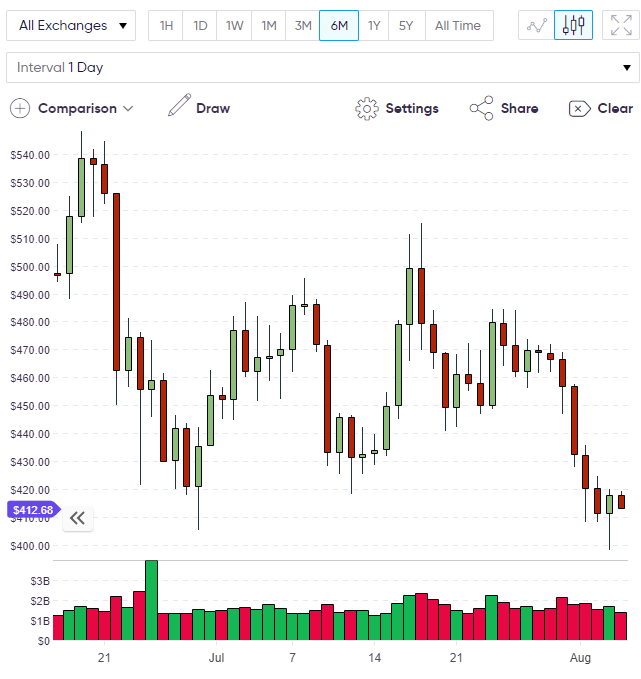

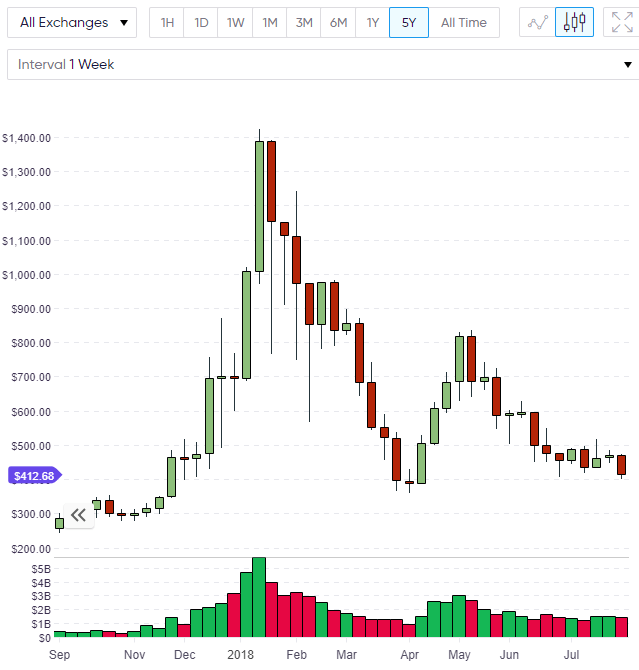

Ethereum posted a bullish close yesterday, likely pulled higher by the ETC news, with a daily closing just under the June low of $420. Although Ethereum is slightly lower today, it’s possible that we can see a small recovery rally in ETH if we close above the $420 level today or tomorrow.

The picture on the weekly level looks less positive with a bearish weekly bar threatening to close under previous support levels around the $440 mark. Key support from April lies at $370 on Ethereum so the next days will be important to dictate the next direction. A further move higher in ETC is possible next week and this may set up the small rally in Ethereum that I have mentioned.

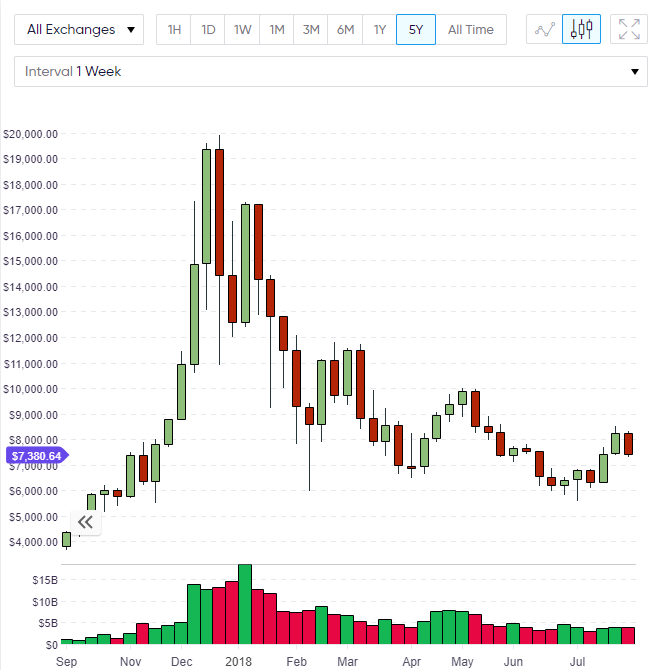

BTC

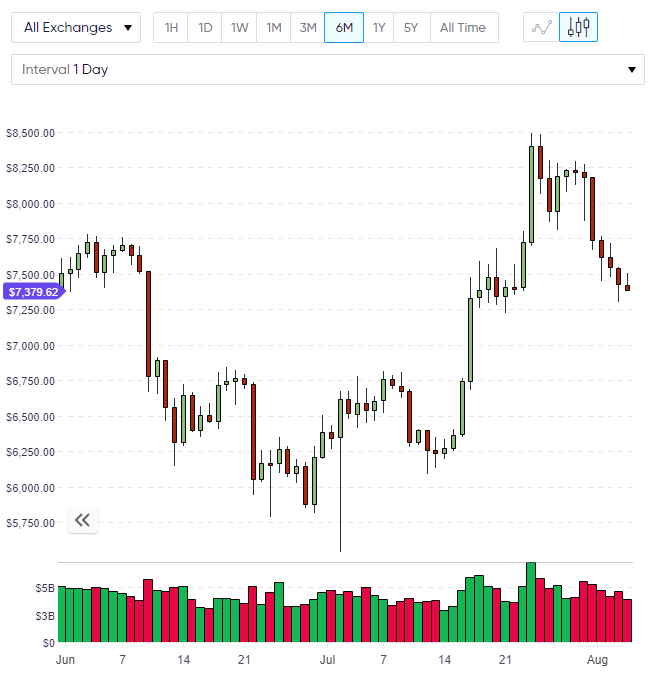

Bitcoin has posted a lower close for the sixth-straight trading sessions and is currently resting at daily support around the $7,300 level. The potential for an Exchange Traded Fund (ETF) or institution-friendly regulation has been put on hold and the same can be said for Bitcoin’s rally.

On a weekly level, I warned that we may see a bearish engulfing bar this week and that appears to be in the making unless we can see a late-rally over Saturday and Sunday. With the G20 pushing their decision on cryptocurrency regulation out to October, it’s possible that Bitcoin will take a pause for a month until the picture becomes clearer for institutional investors. One point I would note about the G20 is that they are friendly with the traditional finance providers and the Winklevoss ETF being rejected is simply a sign that when an ETF comes onboard it may bear the familiar name of a Wall Street corporation.

In a quarterly earnings report, Galaxy Digital, the cryptocurrency merchant bank posted a $100 million net loss and founder Mike Novogratz blamed the “swoon” in digital currencies for the company’s loss. Despite the poor trading result, Novogratz still sees a new wave of institutional money arriving in the cryptocurrency space saying,

If I knew what I know now, knew the crypto markets were going to swoon as much, and it was going to take so long, I might have stayed private for another year or so and then gone public. But I don't think it's a mistake.

Novogratz spoke to Bloomberg in Toronto yesterday and noted that Galaxy were “spending tons of time educating institutional investors”.

In another story related to institutional money and mass adoption of cryptocurrencies, the Intercontinental Exchange, which owns the New York Stock Exchange, has launched a new startup called “Bakkt”, which will be a federally-regulated market for Bitcoin. The company is also partnering with big names such as Microsoft and the Boston Consulting Group, which again highlights the slow creep of corporate giants adopting blockchain technology and an interest in digital currency.

BCH

Bitcoin Cash has tracked Bitcoin lower on the week and is looking at its own bearish close for the sixth consecutive day. On the daily chart, BCH is eyeing support around the $690 level and a close to $700 today would probably see that tested within days.

BCH on the weekly is threatening a close below previous support levels with the potential for the lowest close since March. If we do see a weekly close here or closer to $700 then it would be a concern and BCH could go as low as $640 in the next weeks.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.