Going Public: Bitmain Reportedly Eyeing an $18 Billion IPO for September

Aug 12, 2018, 6:49AMAn Initial Public Offering (IPO) allows a private corporation to raise investment capital by selling shares to the public for the first time.

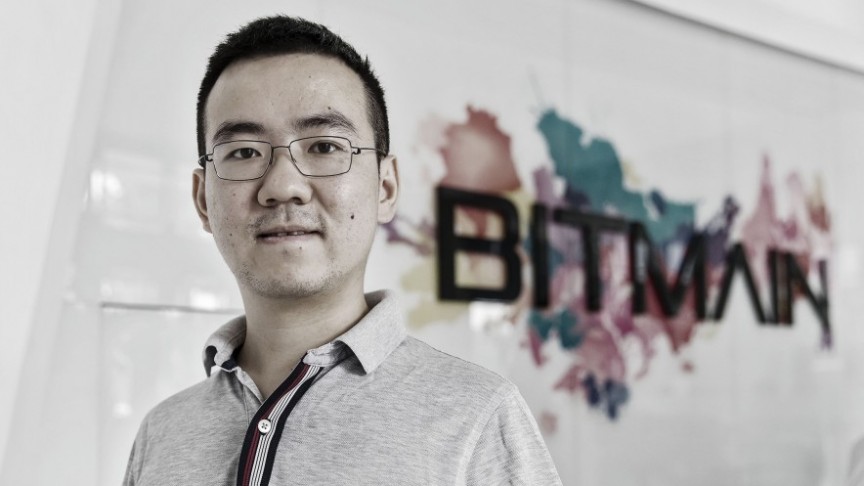

Bitmain Technologies Limited is set to become the world's largest publically-traded cryptocurrency corporation. The Hong Kong-based firm is planning to IPO for a total valuation of up to $18 billion, according to data from Bloomberg. The IPO application is scheduled for September 2018 and follows a pre-IPO financing round of $1 billion. The official launch is set for late 2018 or early 2019.

Initial Coin Offering vs. Initial Public Offering

Unlike the Initial Coin Offering (ICO) process, an Initial Public Offering (IPO) allows a private corporation to raise investment capital by selling shares to the public for the first time. It effectively transforms a private company into a public one and allows its stock to be listed on a public stock exchange.

If it goes through, the Bitmain IPO will follow a series of Chinese Bitcoin miners that have recently gone public. These include Canaan Creative and Ebang Communications which recently filed for $1 billion IPOs on the Hong Kong Stock Exchange. However, Bitmain's possible $18 million IPO will significantly surpass its competitors, even giving mainstream tech giants like Facebook a run for their money.

The Latest in a Series of Funding Rounds

Several news outlets reported that before the IPO application went through, Bitmain planned to raise additional funds through a pre-IPO round. This fundraiser was purportedly backed by Tencent Holdings, Softbank group, and National Gold Group, and closed on July 23 with $1 billion in financing, bringing Bitmain's total valuation to $15 billion. Cointelegraph, however, has since reported that SoftBank denied any involvement in such venture.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.