IOTA Holds Upside Opportunity as BTC and ETH Remain Comatose, Market Oct. 21

Oct 21, 2018, 12:30PMIOTA May Show Some Upside This Week as the Comatose State of BTC and ETH Continues to Increase the Frustration of HODLers.

Bitcoin and Ethereum do not seem like they want to wake up from their induced coma anytime soon, as prices have continued to remain within very tight bands. For cryptocurrencies that make movements of hundreds of dollars on a good day, the situation is making HODLers lose a lot of sleep, especially for those who bought these cryptos at very high prices at the start of the year. But not to worry: some of the overlooked cryptocurrencies are making good moves, and it would be best that we focus on one or two of these ones for today’s analysis.

BTC/USD

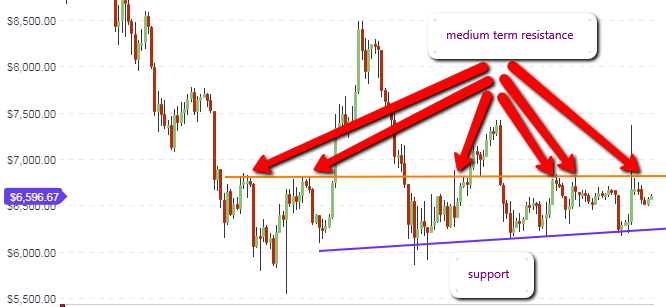

Prices have hardly moved anywhere since Monday’s rollercoaster ride. With BTC/USD trading at just above $6,500, prices are not at favourable levels to buy or sell. This is because this price level is right in the middle of the previously-identified long term price ranges, which continue to remain intact.

A look at the daily chart provides some bit of an insight as to what the key price levels to watch are. A well-defined horizontal resistance price level, formed by previous resistance levels in months gone by, is seen at the $6800 price level. To the downside, the previous support level seen at $6,000 continues to remain valid. The price action remains in between these price levels as can be seen on the chart below.

At the current price, trades are not advised. It is best to allow the price action to navigate its way to either the support or the resistance, before trading decisions can be made. Without any positive news in the cryptocurrency market, price action will continue to be dominated by speculative range trading, buying off dips to support and selling on any rallies to the resistance level.

The price range for the day is too narrow and trading volumes are too thin for any intraday trades.

Outlook for BTC/USD

- Long-term: neutral

- Medium-term: neutral

- Short-term: neutral

IOTA/USD

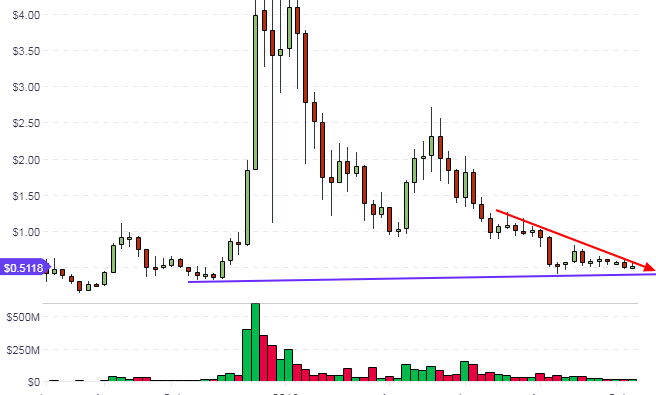

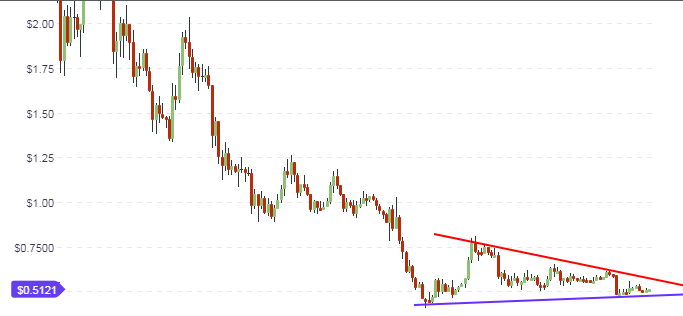

The IOTA/USD crypto pair is looking like a crypto pair that will see some major action pretty soon. This is because the weekly chart reveals price action that is nearing the point of convergence of the long-term support and resistance trendlines. It is safe to say that a breakout may be in the offing. Therefore, traders who have a long-term focus for IOTA should watch to see what price action does in the next few weeks, so as to determine the direction of the break and setup their trades accordingly.

If you prefer to trade IOTA with a medium-term outlook, then you can view the daily chart which shows that the lows and highs of the last few weeks are contained in the symmetrical triangle shown in the chart below.

Price action seems to be on the upside, as the active candle is seen bouncing off the medium term support trendline. As price gets to the point of convergence of the triangle, a break is expected with a greater bias to the upside, as the price of IOTA is already close to its long-term lows.

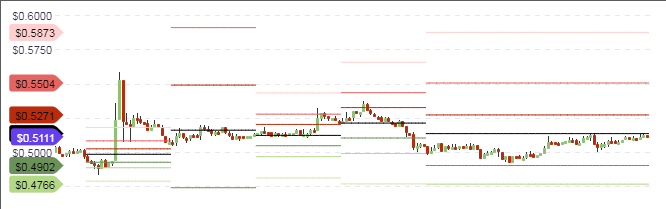

Intraday traders also have something to look forward to. Price is seen being resisted at the central pivot of just above 51.5 cents. There is a potential for an upside break of the central pivot, as the intraday lows are gradually getting progressively higher. If this occurs, then the R1 pivot of 52.71 cents could serve as the upside limit. But if the central pivot holds firm, then the intraday price range will most likely have the central pivot as the ceiling, and the S1 pivot at 49 cents as the floor, with plenty of space in between.

Outlook for IOTA/USD

- Long-term: neutral

- Mid-term: bullish

- Short-term: neutral

XLM/USD

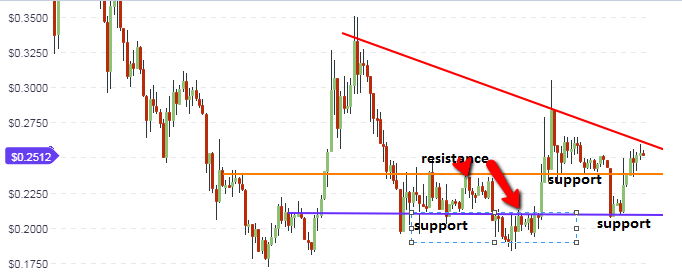

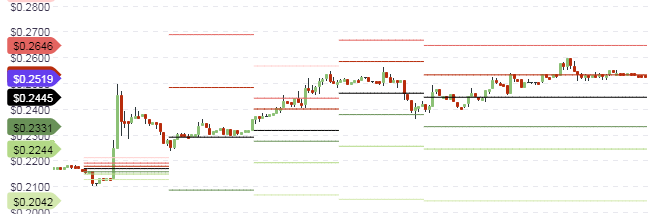

The daily chart of Stellar Lumens shows a price picture which may look complicated to the untrained eye but is indeed simple to understand if a careful analysis of the chart below is made. This chart shows various key levels of support and resistance that have undergone a series of role reversals with the passage of time. Presently, we have an identified horizontal support line (orange), another support line below it (blue) and a descending resistance line.

Price action is very close to hitting the medium term resistance, with very little room to the upside before this area is tested. This area is expected to hold firm, and if it the price is rejected at the resistance area of 26 cents, a drop to the 24 cents support line is likely. It would take some monumental good news in the market to see a break of this resistance. The price action for the week will provide guidance in this regard.

Intraday price action is finding support at the R1 pivot of 25.2 cents. A downside break of this area will open the door for price to attain the central pivot of 24.45 cents. However, trading volumes are very thin. There has to be increased in selling volume to force the move just described above. Otherwise, prices may just keep testing the R1 pivot for the rest of the day.

Outlook for XLM/USD

- Medium-term: neutral to bearish

- Short-term: neutral to bearish

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.