LINK Blasts Higher on DEFI Use, Tik Tok Users Pump DOGE, BTC, LEND, Jul. 11

Jul 13, 2020, 4:51PM by Kevin George

by Kevin George

BTC price is closely tracking stock markets once more and threatens recent gains. Link powers higher on DEFI. Tik Tok users pump DOGE.

BTC

The price of Bitcoin was slightly higher on the week at $9,200, but the price action and recent data are a hint that the price is still tied to U.S. stocks.

Data from Skew showed that the price of BTC was at a record high to the S&P 500 index of stocks. The correlation between the two assets reached 0.79, which implies that Bitcoin tracks the price of stocks very closely. This point was proven in mid-March when the Bitcoin price crashed, dragging the price of altcoins lower. The irony is that stocks were crashing because companies were locked down and the financial system was under threat, which has very little bearing on cryptocurrencies. Less income and liquidity may lead to lower demand for cryptocurrencies, but their entire construct was based on the fact that they were a safe haven from a centralized financial system.

The stock markets have been on a strong run since March, with many prominent investors calling a bubble. Crypto enthusiast Mike Novogratz was one of those who were calling out the prices of the stock market, which he said were, “unhinged from reality”.

Novogratz told Bloomberg:

We are in irrational exuberance -- this is a bubble. The economy is grinding, slowing down, we’re lurching in and out of Covid, yet the tech market makes new highs every day. That’s a classic speculative bubble.

Bitcoin’s price could suffer if stocks see a return to more rational pricing so investors need to be careful. Key resistance sits near the $8,500 level in BTC.

LINK

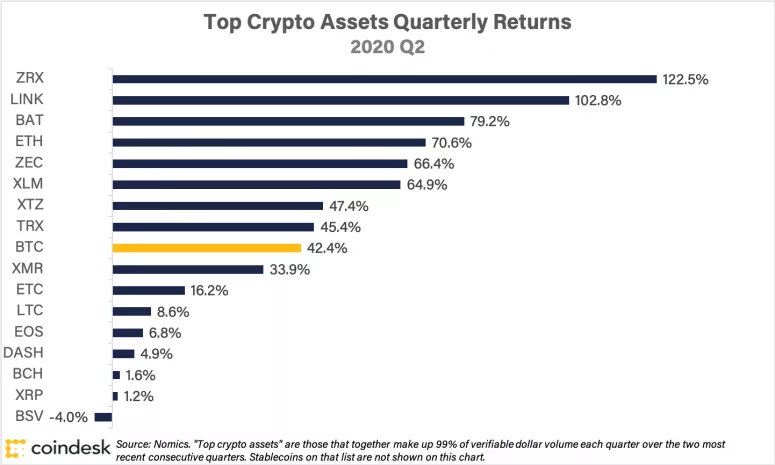

LINK featured in a list of the top second-quarter coins by Coin Desk in second place with a gain of 102%. The coin was up 45% this week and now sits at number 12 in the list of coins by market cap.

Link blasted higher to $6.70 which marked a strong breakout from the $5.00 resistance level and it’s possible that further gains could follow. The coin’s $2.38 billion valuation means that only EOS and CRO stand in the way of a top ten ranking with $2.42 and $2.61 billion valuations respectively.

Chainlink’s price is benefitting from an increase in Decentralized finance (Defi). The market cap for DeFi projects has been soaring in the last six months, with most of the ecosystem now relying on Chainlink for connecting on-chain DeFi smart contracts to off-chain data feeds.

DOGE

Dogecoin was another strong performer with a 59% gain for the week. The price of DOGE seems to be rising on the back of a “pump” scheme by users of the Tik Tok app.

The UK’s Telegraph reported that the user had told his followers: “Let’s all get rich. Dogecoin is practically worthless. There are 800 million TikTok users. Once it hits $1, you’ll have $10,000. Tell everyone you know.”

The price of DOGE was trading at $0.0036 after a spike higher. The ability to continue the price drive may be hampered by the fact that the Tik Toc app is under threat in the U.S. for allegations that the company is providing user data to the Chinese government.

LEND

The price of the LEND coin, which is part of the AAVE lending platform has risen another 63% on the week.

LEND was trading at $0.230 after the latest push higher and will be eyeing the highs near $0.500. The coin was ranked at number 34 in the list of coins by market cap with a $300 million valuation and it will continue higher if demand for the project’s loans continues.

USD

The U.S. Senate Banking Committee held a meeting recently to discuss the path for a digital U.S. dollar. Pressure is mounting on the greenback after China moved closer to the use of its own digital Yuan- the DCEP.

The Chinese cryptocurrency will feature in popular apps like WeChat and AliPay and the U.S. will be concerned that increased usage of the coin could threaten the dollar’s status as the global reserve currency. Countries such as Iran which are subject to U.S. sanctions could easily trade with other markets via the DCEP.

A digital dollar has been added to recent bills in Congress as a means to provide stimulus checks for those unemployed because of the virus shutdowns.

Senator Tom Cotton from Arkansas told the committee,

The U.S. needs a digital dollar...The U.S. dollar has to keep earning that place in the global payments system. It has to be better than bitcoin … it has to be better than a digital yuan.

Sooner, rather than later, the world may be pushed into the use of digital currencies and this could increase the adoption of cryptocurrencies.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.