Rise and Fall: Are Stablecoins the Solution to Crypto Volatility?

Sep 5, 2018, 3:44PM by Mike Dalton

by Mike Dalton

Stablecoins like Tether are gaining ground. Will they solve price volatility once and for all—or cause more problems than they solve?

Cryptocurrency has always been a speculative market that attracts investors who are willing to take risks and endure price volatility. At the same time, cryptocurrency’s proponents have long advocated for cryptos to become as reliable, stable, and practical as fiat.

Since January’s market crash, stablecoins have been climbing through the ranks. Most notable is Tether, a coin tied to the value of the US Dollar, which entered the top 10 lists in June and which is the most popular stablecoin at the moment.

However, Tether is just one of its kind, and many others are vying for their place in the market. What other stablecoins exist, and will they end the era of price volatility or rather create more problems than they solve?

Types of Stablecoins

For a stablecoin to exist, it usually has to be backed by a reserve of assets. As such, different models of backing can be used to classify stablecoins:

Fiat-backed: Stablecoins are backed by reserves, and are tied to the value of the asset held in reserve. Tether is only backed by a reserve of USD, but a single stablecoin can be backed by any asset; EURS, for example, is backed by the Euro.

Crypto-backed: Some stablecoins use reserves of cryptocurrency instead of fiat to dictate their value. For example, Havven backs its stablecoin (Nomins) with its own collateral cryptocurrency (HAV).

Multiple backings: There are various ways to back a stablecoin with multiple assets. Globcoin and X8currency, for example, are tied to a basket of fiat currencies. TrueUSD is a USD-backed token, but it relies on multiple bank partners rather than Tether's single reserve. And MakerDao (Dai) is currently backed by ETH, but will soon support multi-collateral Dai.

Non-backed: Some coins, such as SteemDollar and Basecoin, use complex mechanisms rather than reserves to ensure stable prices. Generally, this involves adjusting the supply as well as inflation and deflation. This may be automated with smart contracts or other programs.

Pros

Stablecoins could affect various aspects of cryptocurrency in several positive ways.

Day-to-day adoption: A coin with a stable value might encourage everyday use of cryptocurrency. One of the reasons that cryptocurrencies aren’t widely adopted for commercial purposes is the fact that customers and vendors can’t rely on prices. If a coin is proven to be stable, many more people would be willing to adopt it.

Long-term transactions: Additionally, stablecoins could facilitate long-term agreements and recurring payments, such as loans and rent. Even those who currently use Bitcoin for immediate payments may find monthly or yearly payments unfeasible.

Two people could, of course, agree on a monthly payment of “$1000 worth of BTC,” but currently one side cannot guarantee that their Bitcoin holdings will be worth enough fiat currency to keep their end of the deal. Crypto-backed stablecoins solve this problem by keeping excess money in a reserve so that individuals don’t have to.

Investing: Stablecoins could encourage investors to keep their money in the crypto market for longer. Since fiat currency is typically stable, crypto investors currently cash out their crypto during periods of high volatility. However, the process of turning crypto into fiat currency is highly regulated, slow, and expensive. Tether is meant to be a stable store of value that, unlike fiat, is easy to reinvest in the cryptomarket.

Cons

As noted, stablecoins have several drawbacks as well.

Lack of transparency: One of the benefits of the blockchain is an open and public record of transactions. However, fiat-based stablecoins complicate this by using private reserves that aren’t easy to investigate. Tether repeatedly puts large amounts of tokens into circulation, leading some to doubt whether it actually has enough USD in its reserves to do so.

Collateral volatility: In the case of crypto-backed coins, volatility remains an issue. If a reserve of, say, Ethereum, is used to back a stablecoin, and the value of Ethereum falls, the stablecoin could lose its value as well. In order to prevent this, reserves must hold excess funds; for example, a stablecoin that is worth 1 ETH might need to be backed by 2 or 3 ETH.

Market manipulation: Since some stablecoins are meant to facilitate trading, that capacity can be abused. Tether has allegedly been misused by wash traders, who inflate the trading volume of various altcoins by trading them for Tether and back again. Exchanges and market analysis sites then report this data incorrectly, which disrupts trading.

Lack of demand: Even if a stable coin is backed by a reserve, it could simply fail and become worthless in the same way that many altcoins do. If Tether spawns too many competitors, they may quickly become forgotten and worthless.

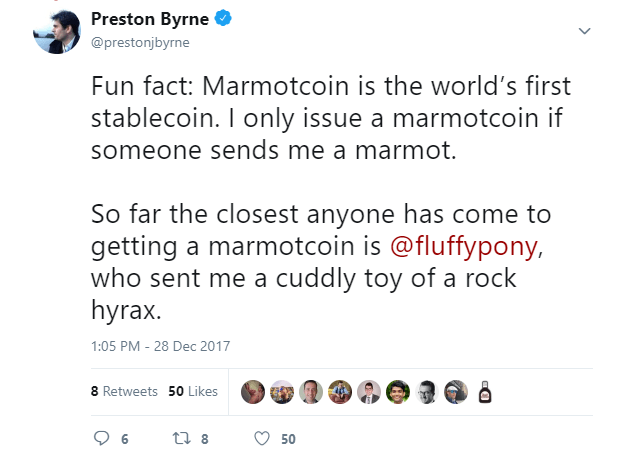

Monax's Preston Byrne has satirized this by introducing Marmotcoin,

Of course, the token doesn't actually exist.

Conclusion

There are many ways to design and back a stablecoin. Tether is unlikely to be the last of its kind, and competition may cause another stablecoin to surpass it. Although there will likely be a lasting place for stablecoins in the crypto market, they won’t solve the volatility problem single-handedly. Their potential downsides must be confronted in order for investors and coin holders to actually rely on them.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.