The Cryptocurrency Market Dips: Binance Coin Bucks the Trend

Jun 22, 2018, 7:04AMThe cryptocurrency market is red today with most of the top 100 assets posting single-digit declines in the last 24 hours.

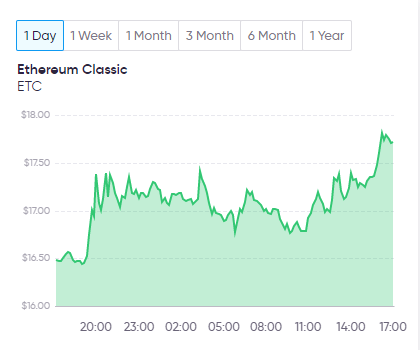

The cryptocurrency market is red today with most of the top 100 assets posting single-digit declines in the last 24 hours. Among the top 10, the declines are led by Ethereum (ETH), Stellar (XLM), and Cardano (ADA), all posting dips of between 2-3%. Several assets buck the trend in the market including Binance Coin (BNB) Ethereum Classic (ETC), and Nano (NANO). These cryptos all post gains between 5-10% on the back of positive news catalysts and favorable technical patterns.

The value of the total cryptocurrency market has fallen slightly to $285.8 billion with Bitcoin dominance steady at 40.2% of the total. Market correlations among the assets seem to be weaker compared to yesterday, but the trend in performance remains similar with market transaction volume remaining lower than its monthly average at around $11.6 billion.

Binance Coin Listed on Changelly Exchange

Out of the top 100 assets, Binance Coin has consistently posted a relatively weak market correlation with the rest of the cryptocurrency market. This has resulted in market-beating performance over the last seven days. The latest move comes a day after Changelly, a popular crypto exchange known for its competitive exchange rates, announced its partnership with Binance, and agreed to list the BNB token on its platform.

It is unclear how much this news event is impacting prices for BNB, but the token is up 5.20% in the last 24 hours to a per unit price of $16.87 and a total market cap of $1.92 billion - this valuation earns it the 15th spot on Coinmarketcap.com, just under Monero (XMR) and Dash (DASH).

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.