The NYSE Owner's New Bitcoin Market Could Poison the Crypto Well, Wall St. Vet Warns

Aug 22, 2018, 9:25AMRegulated Bitcoin platforms such as Bakkt could introduce unwanted elements of fractional reserve banking into the cryptocurrency market.

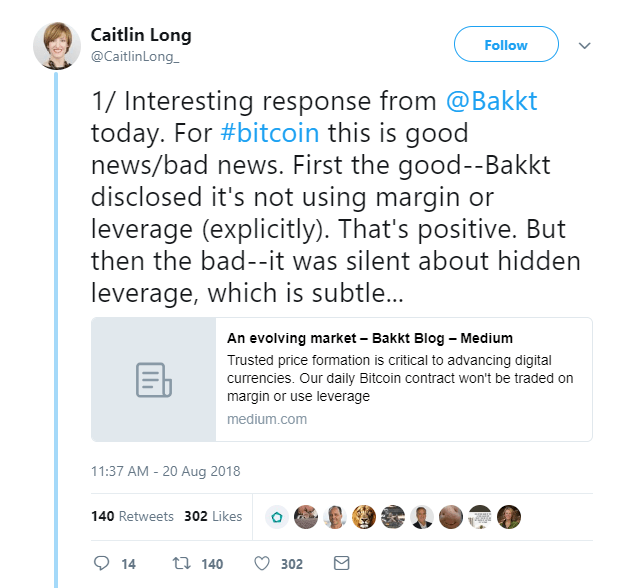

The cryptocurrency market has been struggling lately, and many observers blame growing institutional involvement and financialization in the sector. Caitlyn Long is one of those voices. As Wall Street veteran and the founder of Wyoming Blockchain Coalition, Long raises concerns about how regulated Bitcoin platforms such as Bakkt could introduce unwanted elements of fractional reserve banking into the cryptocurrency market.

The Financialization of Crypto

Bakkt is a platform set to launch in November as a federally-regulated market for Bitcoin. The venture is backed by Intercontinental Exchange, the parent company of the New York Stock Exchange, and is designed to make cryptocurrency more accessible to institutional investors. Bakkt will also offer a one-day clearing Bitcoins futures contract, and this feature has some observers worried the platform could introduce unwanted leverage into the market.

Kelly Loeffler, the CEO of the project, responded to these concerns,

A critical element to price discovery is physical delivery. Specifically, with our solution, the buying and selling of Bitcoin are fully collateralized or pre-funded. As such, our new daily Bitcoin contract will not be traded on margin, use leverage, or serve to create a paper claim on a real asset. Coupled with a secure, regulated warehouse solution, you can begin to see how this market infrastructure can help more institutions and consumers participate in the asset class.

Despite the remarks, some observers still aren't satisfied. Caitlyn Long notes that Loeffler's response is silent on what she calls "hidden leverage", the substitution of different types of collateral on the balance sheet or multiple parties reporting ownership of the same asset. So far, the Bakkt team hasn't responded to Long's additional concerns.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.