VEN Suffers Fall as Mainnet Goes Live, NEO, ETH and XRP Market Analysis: August 3

Aug 3, 2018, 9:50AM by Kevin George

by Kevin George

The price of VeChain has tumbled since its MainNet went live, with the price hovering near its previous lows around $1.60.

VEN

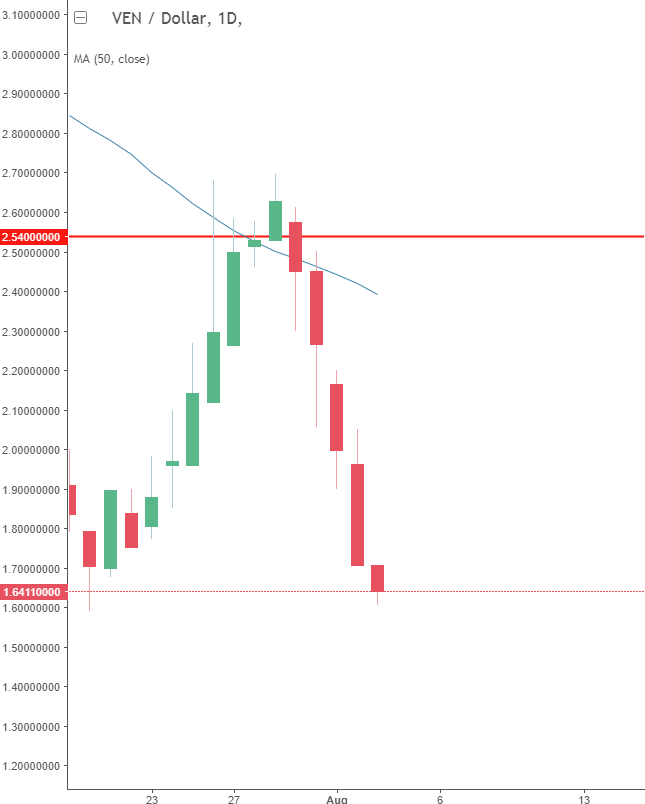

The price of VeChain has tumbled since its MainNet went live on July 30, with the price hovering near its previous lows around $1.60. However, much of the fall in price is likely to be related to a market re-pricing after the token swap which took place ahead of the date, with every holder of 1 ERC20 VEN token receiving 100 VET tokens.

In my last article regarding VeChain, I noted that price was approaching a key downtrend resistance line above $2.50 and would need to see a close above that level on the week to signal further positive gains. The market was unable to break that downtrend line and we have since retreated back to the $1.60 level. The immediate support lies at $1.60 and if it produces a floor for the price then another test of the $2.50 region would be possible.

The fall in price may come to represent value as the company develops the new VeThor blockchain system. In the project’s white paper, the developers noted,

VeChainThor humbly stands on the previous discoveries of Ethereum (Blockchain 2.0) and Bitcoin (Blockchain 1.0). Because of them, we have been able to design a complete, holistic blockchain with the governance structure, token economies, regulatory compliance, and community ecosystem to continually and incrementally evolve the blockchain protocol to absorb any innovation and satisfy the needs of the community, investors, enterprise clients, and academic and governmental partners.

If the VeChain blockchain is really a 3.0 version superior to Bitcoin and Ethereum then the price would have value at these levels. VeChain currently has a market capitalization of $911 million, which is small in comparison to Ethereum at $41 billion, and of course Bitcoin, with its $126 billion market value. These market capitalizations are important to note after the news yesterday that tech giant Apple, had become the world’s first trillion dollar company by market cap. If you consider that Apple is a small part of the financial ecosystem then it once again highlights the money that could flow towards the cryptocurrency space if regulatory approval encourages larger institutional investment.

NEO

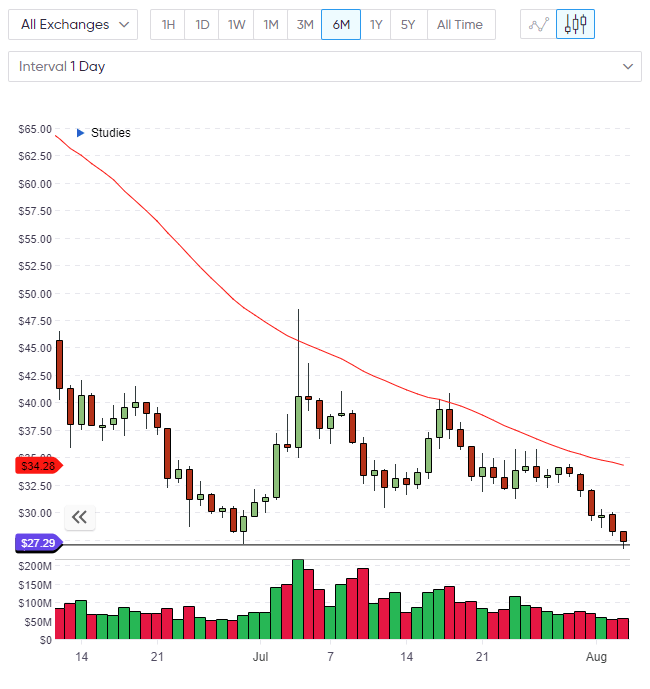

The price of NEO has been falling this week after a failure to retest the 50 moving average and we are now testing a key support level on the daily chart around the $27.00 level. If the price cannot find support at this level then a weekly close below the support level could open up a move lower with a cluster of support lying towards the $20.00 level. NEO could still turn its fortunes around on the week with some buying at this current level for a move back through the $30s, although the market is lacking bullish sentiment at the moment. A catalyst in the near future may be the arrival of the NEO 3.0 software upgrade, which developer Erik Zhang has said will be enterprise ready and capable of handling large-scale distributed applications. He also noted that the platform’s economic model will be adjusted to make the deployment of smart contracts cheaper. There is talk of making the NEO token divisible and this may be the reason for the bearish activity in price in investors fear a token split similar to VeChain.

ETH

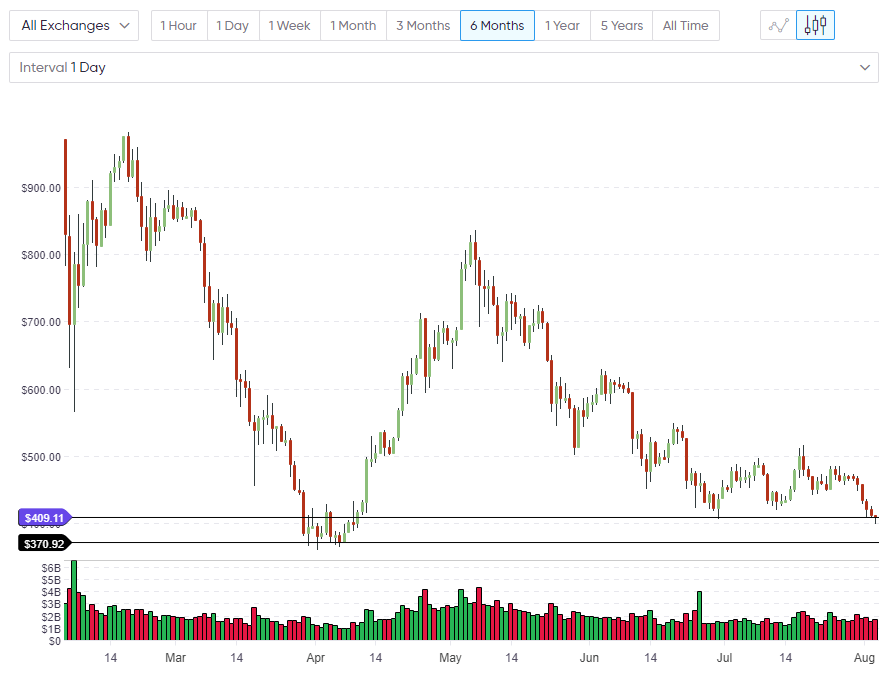

The price of Ethereum has drifted lower over the last few days as the negative week for cryptocurrencies drags the overall market lower. Ethereum is currently seeking to make a support level at the June lows around $408. Below that level there is a weekly support level at $370. The two levels would contain the price in the near future, but the price may attempt a corrective rally here after a run of six negative days.

In a recent Bitrates article, it was noted that the Commonwealth Bank of Australia had successfully tracked a commodity shipment from Australia to Austria over the blockchain. The experiment was done to test an Ethereum hosted application so it is important to note the use of Ethereum if it was to be rolled out as the benchmark for the global shipping industry. The CBA was an early adopter of blockchain technology and previously partnered with Wells Fargo, both of whom were supporters of Ripple’s technology also.

XRP

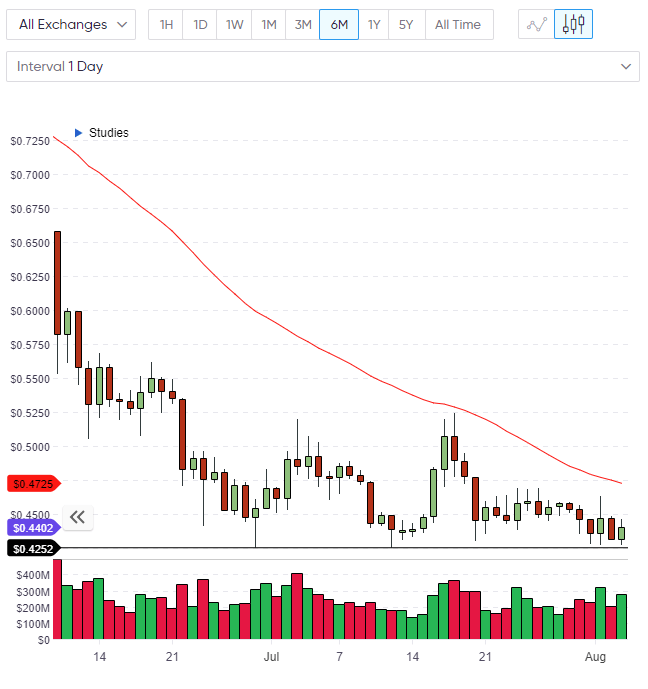

The price of XRP has been more stable than many other coins this week with the price hovering at a support level from June. There has been no strong selling on XRP here so it’s possible that it may attempt to move higher to test the 50 moving average which currently rests at the $0.47 level. On the weekly chart it should be noted that XRP has been trading in a very small range which indicates a decline in volume. The price is therefore vulnerable to a breakout with $0.4250 on the downside and $0.480 on the upside, being the key levels to watch in the next few weeks.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.